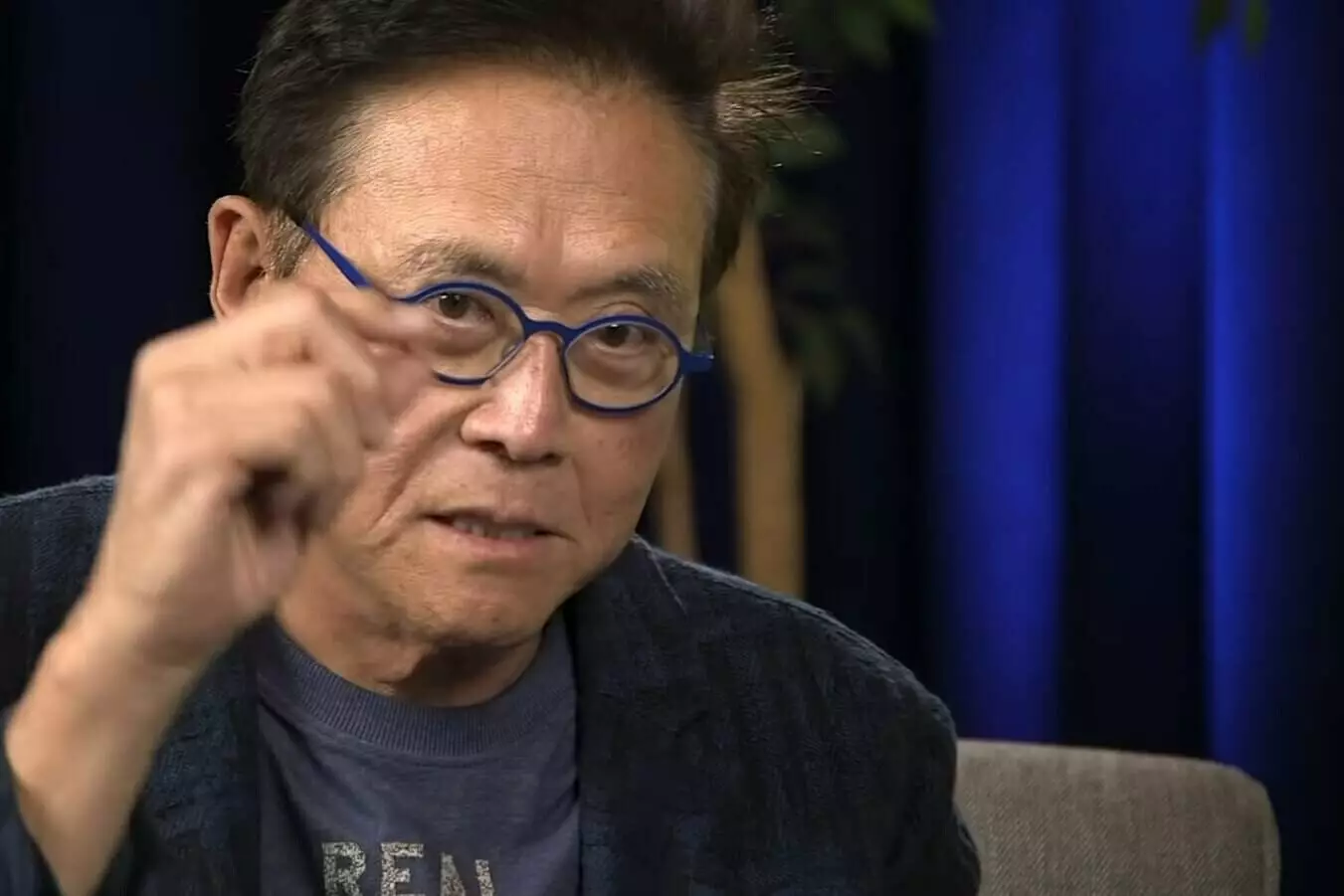

Renowned author Robert Kiyosaki, famous for his personal finance book “Rich Dad Poor Dad,” has expressed pessimism about the future of the US dollar following reports that BRICS nations are planning to introduce a gold-backed currency. According to Russia Today (RT), the official announcement of this agreement is expected to take place in August during an alliance summit in Johannesburg, South Africa. In response, Kiyosaki has predicted the imminent “death” of the US dollar, with Bitcoin surging to $120,000 per coin.

Kiyosaki’s forecast for Bitcoin aligns with Standard Chartered’s recent prediction for the cryptocurrency’s price by the end of 2024. The bank had previously projected Bitcoin to reach $100,000 in April. Kiyosaki has consistently advocated for precious metals and Bitcoin as alternatives to traditional government currencies. He is also known for his dramatic predictions about the US economy and financial system.

While some of Kiyosaki’s more extreme predictions have not materialized, his lack of confidence in the US dollar resonates with a growing sentiment, particularly within the cryptocurrency community. Arthur Hayes, co-founder of BitMEX, had previously suggested that the world may witness the fragmentation of multiple currency blocs due to inflationary pressures on the US dollar. This would ultimately weaken the dollar’s position as the global reserve currency. Similarly, Jeremy Allaire, CEO of Circle, highlighted the active process of de-dollarization, attributing it to declining trust in the US banking system after the failure of Silicon Valley Bank.

Even former US President Donald Trump, who was skeptical about Bitcoin, predicted the loss of the dollar’s status as the world reserve currency. Trump acknowledged the declining value of the US currency, stating it would be a significant defeat after two centuries of dominance.

There have been indications throughout this year that countries are gradually moving away from relying on the US dollar for global trade. For instance, in March, Chinese and French energy companies agreed to settle a liquefied natural gas deal using the Chinese Yuan (CNY). Additionally, Brazil and China signed a trade agreement to use their respective currencies instead of the US dollar.

The shift away from the US dollar as the dominant global currency is not a new concept. However, recent developments and prominent figures expressing their doubts about the dollar’s future have brought renewed attention to this issue. The BRICS nations’ reported agreement to establish a gold-backed currency further supports the notion that the US dollar’s position may be weakening.

As uncertainty surrounding the US dollar grows, alternative assets like Bitcoin and precious metals gain traction as potential safe-haven investments. Bitcoin’s decentralized nature and limited supply make it an attractive option for investors seeking to hedge against the devaluation of traditional currencies. With increasing momentum behind the de-dollarization movement, the future of global finance appears to be entering a new era.

Leave a Reply